What is MSME registration?

In India, the term “MSME” stands for Micro, Small and Medium Enterprises. These are businesses of a smaller scale than large corporations. The registration referred to here is the process through which a business obtains recognition under government rules as an MSME. Recognised registration means the business qualifies for certain schemes, benefits and legal recognition.

According to the Ministry of Micro, Small & Medium Enterprises (M/o MSME), the new classification of MSMEs (manufacturing or services) is based on two criteria: investment in plant & machinery (or equipment) and annual turnover.

Micro: investment ≤ ₹ 2.5 crore and turnover ≤ ₹ 10 crore.

Small: investment ≤ ₹ 25 crore and turnover ≤ ₹ 100 crore.

Medium: investment ≤ ₹ 125 crore and turnover ≤ ₹ 500 crore.

The process of registration gives your enterprise a formal identity and access to support mechanisms. For example, businesses register via the Udyam Registration Portal (launched July 2020).

Why is MSME registration important?

Here are the key reasons you (or clients you advise) should register:

Formal legal recognition: When your business is registered, it becomes easier to engage with banks, government schemes, procurement, etc.

Access to benefits & schemes: Registered MSMEs often qualify for subsidies, cheaper credit, priority in government tenders, protection in delayed payments. (Many sources highlight these advantages.)

Better credibility: Clients, suppliers and financing institutions often view a registered MSME as more credible than an unregistered small business.

Statistical tracking & support: The government tracks MSME registrations to plan support, so being in the system makes you visible. For instance, as of May 2025 about 6.44 crore MSMEs were registered on the Udyam Portal & Assist Platform.

Step-by-step process of registering for MSME

Here is a practical walkthrough:

Visit the official portal (Udyam Registration). The process is free, online and paperless.

Provide Aadhaar number, PAN & GST as required. (From 01.04.2021, having PAN & GST is mandatory for registration.)

Fill in business details: Name, address, bank account, turnover, investment, etc.

Submit self-declaration. No upload of supporting documents is needed at the time of registration (the portal integrates with Government databases).

After submission your enterprise receives an Udyam Registration Number (URN). Keep this for future use in schemes and benefits.

Update your details if business scale or turnover changes (because classification threshold may then shift).

Tip for your clients: Encourage them to register early (if eligible), because later changes in business scale may lead to re-classification and extra compliance.

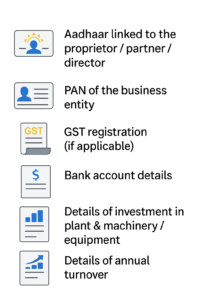

Documents for MSME Registration

Aadhaar linked to the proprietor / partner / director

PAN of the business entity

GST registration (if applicable)

Bank account details

Details of investment in plant & machinery / equipment

Details of annual turnover

Documents for MSME Registration

Lower interest or priority credit via banks

Subsidised machinery / technology up-gradation schemes for MSMEs

Participation in government procurement (many government tenders reserve a share for MSMEs)

Protection under the “Delayed Payment to Micro & Small Enterprises” Act (helps small businesses get paid on time)

Brand recognition: Being “MSME‐registered” can help in marketing, attracting trust, potential customers or suppliers

Being able to tap cluster-development programmes, training and capacity building offered by MSME ministry or state governments

Common Mistakes & How to avoid them

Assuming registration means “free money”: Registration is a gateway, not a guarantee. You still need to apply/apply properly for specific schemes.

Wrong classification assumptions: If you cross thresholds you may no longer be under the same benefits — watch your investment and turnover.

Missing updates: Business changes (e.g., turnover grows) should be updated in the portal to avoid compliance issues.

Using unofficial agents: The portal is free, official, and self-declaration based. There is no authorised private intermediary.

Poor record-keeping: Even though the portal doesn’t require document upload at registration, you should maintain logs of turnover, investment, etc., to defend any audit or inquiry.

Conclusion

Getting your business registered under the MSME framework is a smart and strategic step for small and medium enterprises in India. It doesn’t cost (registration is free), it is straightforward, and it unlocks a range of benefits — from credibility and access to schemes, to marketing leverage and formal recognition. For any entrepreneur or business owner thinking of scaling up or formalising operations, MSME registration is a strong piece of the puzzle.

If you’re unsure about eligibility, process or benefits — reach out to an agency (or expert) who can guide you step-by-step. As part of your journey, once you have your URN, ensure you use it actively: mention it on your website, include it in proposals, and explore government schemes.

Need Help With MSME Registration?

If you want a smooth and error-free MSME Registration, Sublime ConsulTeam is here to guide you.

We help you complete the process correctly, understand eligibility, and secure all documents without confusion.

MSME Registration – FAQs

What is MSME Registration Online?

MSME Registration online is the process of registering your business on the official Udyam Portal. It helps micro, small and medium businesses get recognition and access government benefits. The entire process is digital, quick and free.

How can I download the MSME Registration Certificate?

After completing your Udyam Registration, you can download your certificate by signing in on the official portal with your mobile number and OTP. The certificate includes your Udyam Registration Number (URN) and business details.

What is the MSME Registration Portal?

The MSME portal is the official government website where entrepreneurs register their businesses under the MSME category. It provides a simple interface to apply, update and download certificates.

What is MSME Registration through CSC?

CSC (Common Service Centre) offers assisted registration for people who need help completing the online form. They support rural and urban users who may not want to complete the process themselves.

How to do MSME Registration in Delhi?

MSME Registration in UP follows the same national process. You must apply on the official Udyam portal, enter Aadhaar, PAN, GST details and submit your business information. Once approved, your certificate is issued online.

What are the fees for MSME Registration?

There is no government fee for MSME registration. The official process is completely free. If you take help from a consultant, they may charge a service fee, but the government does not.

Is MSME Registration online free?

Yes. The government does not charge anything for the registration. You only need to provide basic details and verify with OTP.

How do I log in for MSME Registration?

You can log in using your registered mobile number on the Udyam portal. An OTP is sent to your mobile, and after verification you can view or update your details and download your certificate.